News and Events

Stay up-to-date with the latest news, events, press releases, and insights from the professionals at Launch – Development Finance Advisors

The Launch Report™ – First Quarter 2025

In this edition of The Launch Report™ you will find why public financing is more important than ever, macro forces reshaping the new housing market, RCLCO's Top Selling Master Planned Communities, and how the MUD Forward Funding Launch…

The Launch Report™ – Fourth Quarter 2024

In this edition of The Launch Report™ you will RCLCO's Top Selling Master Planned Communities, the growing importance of public financing, and how The MUD Foward Launch Bond® is transforming Texas MPC funding. Lastly, we have included…

The Launch Report™ – Third Quarter 2024

In this edition of The Launch Report™ you will find news on Caldwell Companies and Hillwood Communities recent The Launch Bond® transactions as well as articles related to the; 10 Costly Reimbursement Processing Blunders in addition to…

The Launch Report™ – Second Quarter 2024

In this issue of The Launch Report™ you will find articles related to potential changes in the calculation of California impact fees, Texas PID financing opportunities created by decreasing property tax rates, and much more.

We hope that…

The Launch Report™ – First Quarter 2024

In this issue of The Launch Report™ you will find articles related to AZ Proposition 117 and how Prop. 117 eliminates the need for Developer Standby Contribution Agreements. We also look at the US Supreme Court’s ruling on Sheetz v. The…

The Launch Report™ – Fourth Quarter 2023

In this issue of The Launch Report™ you will find articles related to the three components of IRR and how to positively impact your Project’s IRR as well as new issuances of the Texas Forward Funding Launch Bond™. We have added Land…

The Launch Report™ – Third Quarter 2023

In the Q3 Edition of The Launch Report™, we will learn about Land Light strategies and how they can benefit Home Builders and Landowners. We also include the 2023 Mid-Year Top Selling Master Planned Communities Report sent out by RCLCO,…

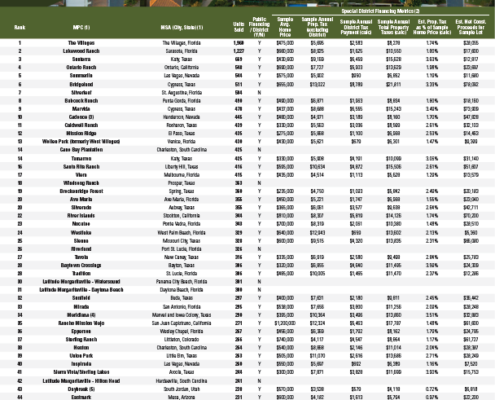

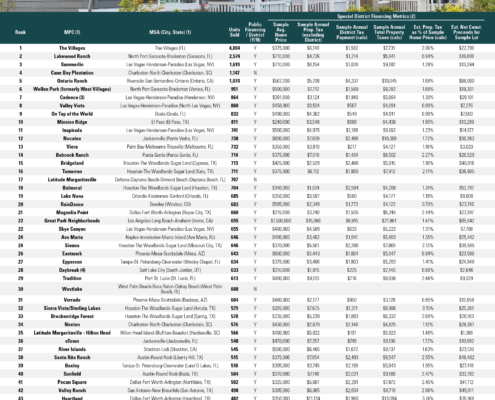

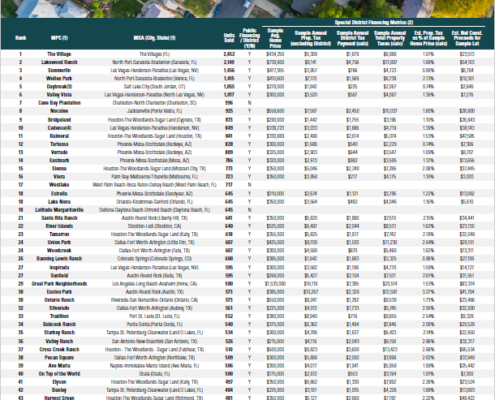

Top Master Planned Communities Rely on Public Finance – RCLCO / Launch Mid-Year 2023 Infrastructure Financing Mechanisms

Launch Development Finance Advisors, partnering with RCLCO Real Estate Consulting, delivered its Mid-Year 2023 Infrastructure Financing Mechanisms for the Top 50 Master Planned Communities (MPC). Among the findings in this report, developers,…

The Launch Report™ – Second Quarter 2023

In the 2Q 2023 issue of The Launch Report, you’ll find a description of the innovative non-recourse, tax-exempt MUD Forward Funding Capital Appreciation Bond developed by Launch to accelerate the receipt of construction proceeds into a…

The Launch Report™ – First Quarter 2023

In the Q1 2023 Launch Report, we outline the reasons for the continued increase in homebuilder sentiment. We lay out powerful financing tools that our clients can utilize in Texas to help access non-recourse, long-term, tax-exempt bond financing…

The Launch Report™ – Fourth Quarter 2022

In this quarter’s Launch Report™, we’ve outlined 22 ideas to position your project for “the next wave”. Additionally, get the details on how RCLCO’s Top 50 Selling Master Planned Communities are financing their infrastructure…

The Launch Report™ – Third Quarter 2022

In this issue of the Launch Report™, you'll find a common oversight that we have witnessed time-after-time during down markets that without proper attention, could cost your company millions of dollars.

Furthermore, we've included RCLCO's…

The Launch Report™ – Second Quarter 2022

In this issue of the Launch Report, we have in interview with Brook Cole of GWC Capital on how they stay on time and on budget with the build out of their 6,000+ acre Spring Valley master plan community located in Boise, Idaho. Additionally,…

View Panel Discussion on Impact of Rising Interest Rates

Rising interest rates are impacting how land developers and builders are looking at the market. Click on the link below to learn more.

https://www.youtube.com/watch?v=LTMXIanXma0

The Launch Report™ – First Quarter 2022

In this issue of the Launch Report we layout 45 development strategies that may be helpful as we move forward in an environment of increasing horizontal construction costs, supply chain challenges, and rising interest rates.

I hope you…

How the top selling master planned communities are financing infrastructure

RCLCO Real Estate Advisors (“RCLCO”), along with Launch Development Finance Advisors, have updated their listing for year-end 2021 outlining how the 50 Top-Selling Master Planned Communities in the United States are financing their infrastructure.…

The Launch Report™ – Fourth Quarter 2021

This issue of The Launch Report™ is dedicated to the memory of Larry Johnson, founder of Johnson Development Corporation, and one of the nation’s most successful developers who unexpectedly passed away in January 2022. Michael Cox, President…

The Launch Report™ – Third Quarter 2021

In this issue of The Launch Report™ you will find an in-depth interview with Heath Melton, the President of Howard Hughes Phoenix Division in relation to their recent acquisition of the 37,000 acre Douglas Ranch master planned community…

The Launch Report™- Second Quarter 2021

In this issue of The Launch Report™ you will find a multimedia presentation by Carter Froelich (Launch Development Finance Advisors) and Misty Ventura (Shupe Ventura, PLLC) related to Infrastructure Financing Solutions for Texas Developers…

The Launch Report™ – First Quarter 2021

In the 1Q21 issue of the Launch Report you will find Land Advisors Organization’s residential land market overview for 18 markets; a check list of 25 potential land mines to avoid during a frothy real estate market; the tangled mess of…

How the Top Selling Master Planned Communities are Financing Infrastructure

RCLCO Real Estate Advisors (“RCLCO”), along with Launch Development Finance Advisors, have updated their listing for year ended 2020 related to how the 50 Top-Selling Master Planned Communities in the United States are financing their…

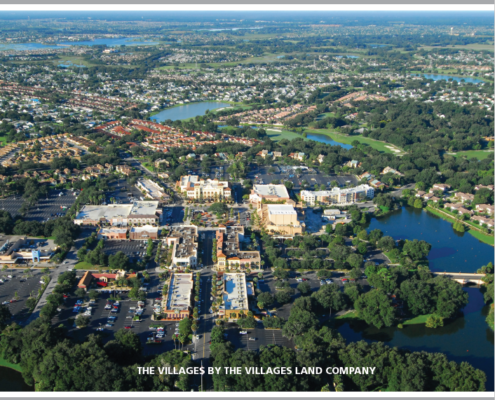

The Launch Report 4Q2020 – Interview with Mark Morse of The Villages

In this quarter’s Launch Report we are excited to provide an interview with Mark Morse and IV Chandler of the Villages Land Company related to the success factors that have made The Villages the top selling master planned community for…

The Launch Report™ – Third Quarter 2020

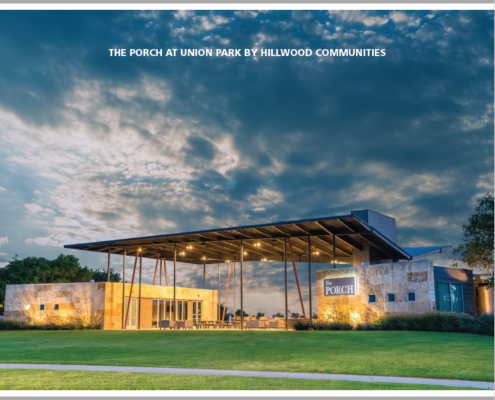

In this quarter’s issue of The Launch Report we have dedicated the entire issue to an interview with Fred Balda and Elaine Ford of Hillwood Communities on the topic of creating community within master planned communities. I think that…

Another Successful Closing – Sunstone

Sunstone (Phases I & II)

City of Las Vegas, Nevada

$18,600,000

October 20, 2020

Yield: 4.16%

Maximum Term: 29.5 years

Value-to-Lien Ratio: 4.29 to 1

Average Assessment Per Unit: $11,171

Average Assessment Lien Per Assessable…

The Launch Report™ – Second Quarter 2020

We are happy to present the Launch Report for the second quarter of 2020.

In this issue, Randall Lewis of the Lewis Group of Companies, provides observations on the linchpins of successful master planned community development.

In addition…

The Launch Report™ – First Quarter 2020

In this issue of The Launch Report™ you’ll find an article by Tripp Davenport and Robert Rivera of FMSBonds; the premier Public Improvement District (“PID”) underwriters in the state of Texas, on the advantages of using PID's to…

The Launch Report™ – Fourth Quarter 2019

In this quarter's publication of the Launch Report™ you will find articles and information related to:

Markets at a Glance - Land Advisors Organization's residential indexes for selected markets across the US.

Guest Corner…

The Launch Report™ – Third Quarter 2019

Before we outline what is included in this quarter’s Launch Report™, we are happy to announce that Launch Development Finance Advisors has merged with Land Advisors Organization (www.landadvisors.com).

The combination with Land…

RCLCO / Launch Financing Diagnostic of Top-Selling Master Planned Communities

Launch advisors have just completed a financial diagnostic into the RCLCO Real Estate Advisor’s Midyear 2019 Top Selling Master Plan Communities Report in order to estimate the amount of net bond proceeds being generated by special district…

The Launch Report™ – Second Quarter 2019

In this issue of The Launch Report™ you'll find a compelling article by Gregg Logan of RCLCO Real Estate Advisors ("RCLCO") on how demographic trends are up-ending the housing market but simultaneously creating opportunities for developers…

The Launch Report – 1Q19

In this quarter's Launch Report we address the issue of reducing ever increasing infrastructure costs.

Greg Vogel, CEO of Land Advisors Organization, this issue's guest writer, explores what he has dubbed as "the $250 (per front foot)…

Marana Adopts a New CFD Policy

The Town of Marana ("Town") adopted a new CFD policy ("Policy") at its regular Council Meeting on June 4, 2019.

2019 Amended CFD Policy FINAL

The highlights of the Policy include:

A. Two Tiered CFD Structure

Standard Infrastructure…

Buckeye, AZ Adopts Revitalization District Policy

On May 21, 2019 the Buckeye City Council adopted a policy related to the use of Revitalization Districts (“RD”) to assist in the financing of ever increasing infrastructure costs. This is an important milestone for the City and proves that…

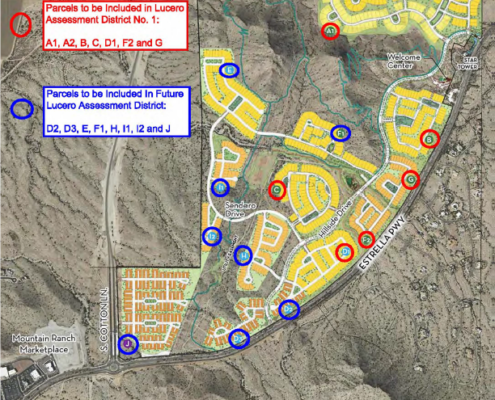

Another Successful Closing – Estrella Mountain Ranch

Lucero Assessment District No. 1

Goodyear, AZ

$6,913,000

Bond Type: Special Assessment

Closing Date: April 26, 2019

Average Coupon: 4.46%

Maximum Term: 25 years

Overall Value-to-Lien Ratio: 4.86 to 1

Average Assessment Per Unit: $13,218

Purpose:…

Inaugural Issue – The Launch Report

We are happy to announce the inaugural issue of The Launch Report, Launch Development Finance Advisor’s Quarterly Newsletter.

In this issue you will find information on: fourth quarter 2018 market statistics;…

RCLCO / Launch Top 50 MPC Financing Report

RCLCO Real Estate Advisors (“RCLCO”) and Launch Development Finance Advisors ("Launch") have updated the financing mechanisms used by the RCLCO’s Top Selling Master Planned Communities for the year end 2018. See how MPC are financing…

Another Successful Closing – Skye Canyon

Skye Canyon – Phase III

Las Vegas, Nevada

$12,500,000

Average Yield: 4.92 %

Maximum Term: 30 years

Value-to-Lien Ratio: 4.1 to 1

Average Assessment Per Unit: $9,750

Launch Development…

Another Successful Closing – Rainbow Canyon

Rainbow Canyon – Phase I

Henderson, Nevada

$17,805,000

Average Yield: 5.18%

Maximum Term: 30 years

Value-to-Lien Ratio: 7.49 to 1

Average Assessment Per Unit: $12,745

Underwriter: Stifel Nicolaus

Purpose: To reimburse…

How are MPCs Financing Infrastructure?

RCLCO Real Estate Advisors (“RCLCO”) and Launch Development Finance Advisors (“Launch”) have updated RCLCO’s list of the Top Selling Master Planned Communities to include information related to those projects incorporating special purpose taxing districts to finance public infrastructure.

Buckeye, AZ Considering Capacity Fee

The City of Buckeye, Arizona held a meeting with the development community on October 4, 2018 to discuss the possibility of establishing a water and sewer capacity fee.