In this edition of The Launch Report™ you will find why public financing is more important than ever, macro forces reshaping the new housing market, RCLCO’s Top Selling Master Planned Communities, and how the MUD Forward Funding Launch Bond® program is revolutionizing Texas MPC funding. Lastly, we have included all the Land Advisors Organization’s Q#1 2025 Markets at a Glance.

In this edition of The Launch Report™ you will RCLCO’s Top Selling Master Planned Communities, the growing importance of public financing, and how The MUD Foward Launch Bond® is transforming Texas MPC funding. Lastly, we have included all the Land Advisors Organization’s Q#4 2024 Markets at a Glance.

In this edition of The Launch Report™ you will find news on Caldwell Companies and Hillwood Communities recent The Launch Bond® transactions as well as articles related to the; 10 Costly Reimbursement Processing Blunders in addition to Seven Critical Errors That Can Derail Your Special District Financing. Lastly, we have included all the Land Advisor’s Organization’s Q#3 2024 Markets at Glance.

In this issue of The Launch Report™ you will find articles related to potential changes in the calculation of California impact fees, Texas PID financing opportunities created by decreasing property tax rates, and much more.

We hope that you enjoy this quarter’s issue of The Launch Report™.

Dig Deep and Build Strong!

In this issue of The Launch Report™ you will find articles related to AZ Proposition 117 and how Prop. 117 eliminates the need for Developer Standby Contribution Agreements. We also look at the US Supreme Court’s ruling on Sheetz v. The County of El Dorado, as well as the recent $165MM Texas MUD Forward Funding Launch Bond™. Launch and RCLCO Real Estate Consulting present the Infrastructure Financing Mechanisms for the Top 50 Master-Planned Communities. We have added Land Advisors Organization’s Markets at a Glance Charts, and lastly, we have provided links to the newest episodes of the Land to Lots™ Podcast series.

We hope that you enjoy this quarter’s issue of The Launch Report™.

Dig Deep and Build Strong!

In this issue of The Launch Report™ you will find articles related to the three components of IRR and how to positively impact your Project’s IRR as well as new issuances of the Texas Forward Funding Launch Bond™. We have added Land Advisors Organization’s Markets at a Glance Charts and lastly, we have provided links to the newest episodes of the Land to Lots™ Podcast series.

In the Q3 Edition of The Launch Report™, we will learn about Land Light strategies and how they can benefit Home Builders and Landowners. We also include the 2023 Mid-Year Top Selling Master Planned Communities Report sent out by RCLCO, along with Launch’s updated financing matrix to illustrate just how these top-selling MPCs are financing their infrastructure. We will talk about Texas’s SB 2038 bill which went into effect September 1, 2023, and how SB 2038 will allow landowners to de-annex out of a city. And lastly, we investigate the MUD Forward Funding Launch Bond™ as it compares to the Texas Infrastructure Program (“TIPS”) when looking at Bond Proceeds.

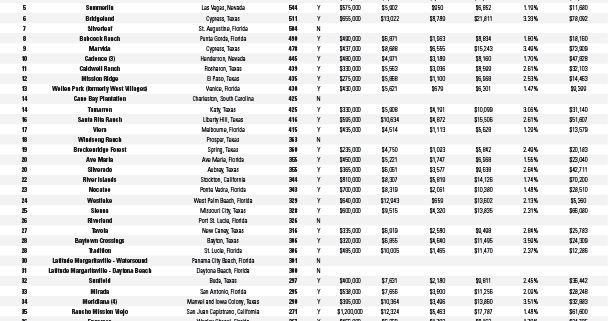

Launch Development Finance Advisors, partnering with RCLCO Real Estate Consulting, delivered its Mid-Year 2023 Infrastructure Financing Mechanisms for the Top 50 Master Planned Communities (MPC). Among the findings in this report, developers, and builders of the top MPCs continue to rely heavily on public financing mechanisms to construct infrastructure with 86% of home sales occurring within a special taxing district.

RCLCO / Launch 2023 Mid-Year Report

Estimated net construction proceeds from special district financing for a sample lot in top selling MPCs averaged over $30,300 with estimated property taxes as a percentage of home prices just under 2.2%.

Texas continues to dominate the list with 22 MPCs in the Top 50, 20 of which use special districts to finance infrastructure. Florida is second with 16 MPCs on the list, 12 of which use special districts.

If you are interested in learning more about special district financing and how it can benefit your project, please contact Pamela Giss at pamelag@launch-dfa.com or call (480) 874-4358.

In the 2Q 2023 issue of The Launch Report, you’ll find a description of the innovative non-recourse, tax-exempt MUD Forward Funding Capital Appreciation Bond developed by Launch to accelerate the receipt of construction proceeds into a project’s cash flow. Additionally, we’ve included an article related to items one should consider when financing MPC related improvements. Lastly, we’ve included links to obtain a free copy of Carter Froelich’s new book, Land To Lots – How to Borrow Money You Don’t Have to Pay Back and LAUNCH Master Planned Communities.

Enjoy and remember to dig deep and build strong!

In the Q1 2023 Launch Report, we outline the reasons for the continued increase in homebuilder sentiment. We lay out powerful financing tools that our clients can utilize in Texas to help access non-recourse, long-term, tax-exempt bond financing via the public debt markets to make deals “pencil”. We’ve also included a listing of last quarter’s Land to Lots Podcasts to allow you to turn your car into a rolling university.

As always, we have included Land Advisors Organization’s Markets at a Glance.

Dig deep and build strong!

Copyright Launch Development Finance Advisors™

Website Designed and Maintained by In-A-Dash Computer Repair