In this issue of The Launch Report™ you’ll find a compelling article by Gregg Logan of RCLCO Real Estate Advisors (“RCLCO”) on how demographic trends are up-ending the housing market but simultaneously creating opportunities for developers who are in tune with this aspect of market dynamics.

Launch Development Finance Advisors provides our insights on how the Top 50 Master Planned Communities as identified in RCLCO’s mid-year 2019 survey are financing their infrastructure.

We also provide an overview of the Public Improvement District statute that was recently passed by the Utah legislature which we anticipate will be the “go to” financing vehicle for master planned developers and builders in Utah.

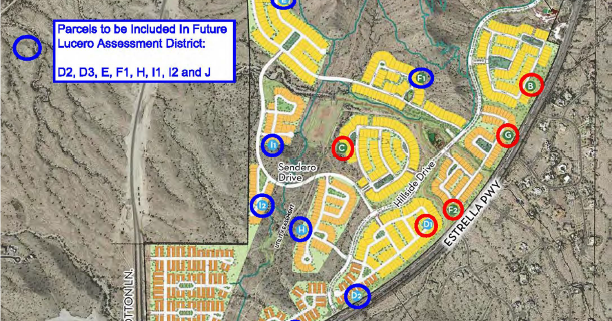

This issue also discusses the ramifications of recent changes to New Mexico’s Public Improvement District statute that impacts the governance of districts and the ability of developers to maintain control of the Districts through the critical financing period.

Lastly, we provide Land Advisors Organization’s snapshot of the second quarter’s housing statistics for selected markets.

Sincerely,

Carter Froelich, CPA

Managing Principal